Your Top 10 4506-T Answers

Taxpayers often ask these questions about IRS Form 4506-T:

1. Why would a person use it? A. This form enables citizens to request copies of previous returns, 1099 documents and W-2 forms from the Internal Revenue Service.

2. Does the government let people ask for any document using Form 4506-T? A. The IRS limits these requests to five different items. They include forms W-2, 1040, 1065, 1099 and 1120.

3. How long does it take the IRS to send the requested information? A. Individuals wait between 10 days and two months. If they request transcripts in bulk, companies may receive the data after one to two days.

4. Is it possible to submit Form 4506-T using a fax machine? A. The Internal Revenue Service allows taxpayers to use its Kansas City fax number.

5. Does the signature on this document expire? A. After a person signs and dates this form, it remains valid until 120 days have elapsed.

6. Can a taxpayer ask for copies of forms from multiple years? A. At most, the IRS permits citizens to request transcripts of tax documents from the previous four years.

7. What information is needed to complete Form 4506-T? A. Taxpayers must provide basic contact details, Social Security numbers and any recent former addresses. Optionally, a person can supply the address of an organization or company that should receive the transcripts.

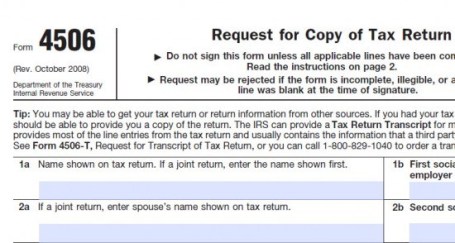

8. How do forms 4506-T and 4506 differ? A. Although people can utilize both of them for the same basic purposes, 4506 is used to request photocopies. On the other hand, taxpayers receive transcripts when they submit Form 4506-T.

9. When does a late or amended return become available? A. It takes 42 to 56 days for the government to update its database and make transcripts or photocopies available.

10. Why would the IRS reject or fail to process this form? A. Unreadable handwriting or inaccurate information can cause this to happen. Be sure to enter prior addresses correctly.