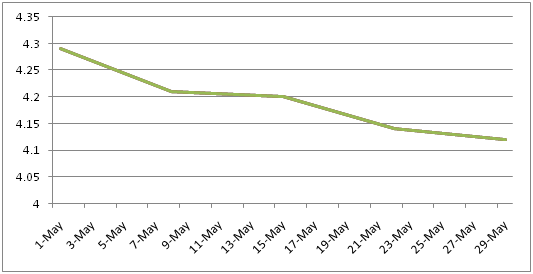

U.S. Mortgage Rate on a Falling Streak

Average 30 year fixed mortgage rate slipped from 4.14% to 4.12% last week. Average 15 year fixed mortgage rate plummeted as well, from 3.25% to 3.21%. This is the fifth straight week of U.S. mortgage rates continuing to tumble down.

The housing analysts are attributing this fall to the shifting of investors’ focus from stocks to mortgage backed securities.

U.S. 30 Year Mortgage Rates for the Month of May

The fall in the mortgage rates varies from region to region. The rates are lowest in the western United States including states like Arizona, Washington, Nevada and California. And not just rates, the mortgage applicants are enjoying lowest fee in these states. In contrast, the rates and fees are highest in South-Eastern and South-Western United States including states like Florida, Georgia, Oklahoma and New Mexico.

Home Sales Volume on Rise

Apparently, lower mortgage rates translate into increased home sales. Let’s see how the mortgage rates have impacted U.S. home sales volume.

At the beginning of the year, the home sales volume was low primarily because of three factors – cold weather, high rates and a low home inventory. The housing market analysts expected that with the advent of warmer weather and plummeting mortgage rates, the home sales volume is going to gain traction. But instead of the plummeting rates, there hasn’t been a substantial boost in the home sales volume. As per the National Association of Realtors, the sales is definitely up compared to the last month but is still far lower compared to the April-May figures of the last year. As for the home inventory, it is certainly on the rise but the new construction is least focused on single-family homes, which is not very favorable for the average U.S. homebuyer.

A Wake-Up Call to Refinance

If you are one of those homeowners, who missed to refinance earlier or waited for the rates to fall down further, here’s your chance to switch to fixed mortgage and lock in your rates. Now when the mortgage rates have plummeted beyond all expectations, this is perhaps the best time to refinance. Housing market analysts believe that a homeowner can save up to 25% by refinancing the loan. If you are concerned whether or not you will qualify for a refinance, bother not. Here’s why. Now when the rates have hit the mark of 4.12%, there are outstanding mortgages in the housing market with rates above the mark of 5%. The value of these outstanding mortgages is above $800 billion. All of this boils down to one thing – Millions of U.S. homeowners are now eligible for a refinance. We hope you are catching up!