Mortgage Industry Trends That You Need to Keep an Eye on for the Rest of the Year

The mortgage industry is constantly changing alongside the fluctuations of the real estate market. While it’s impossible to predict the future of the industry with certainty, experts have identified a few key trends that are likely to affect mortgage lenders and borrowers over the course of the next year. Here are three things to prepare for in the coming months:

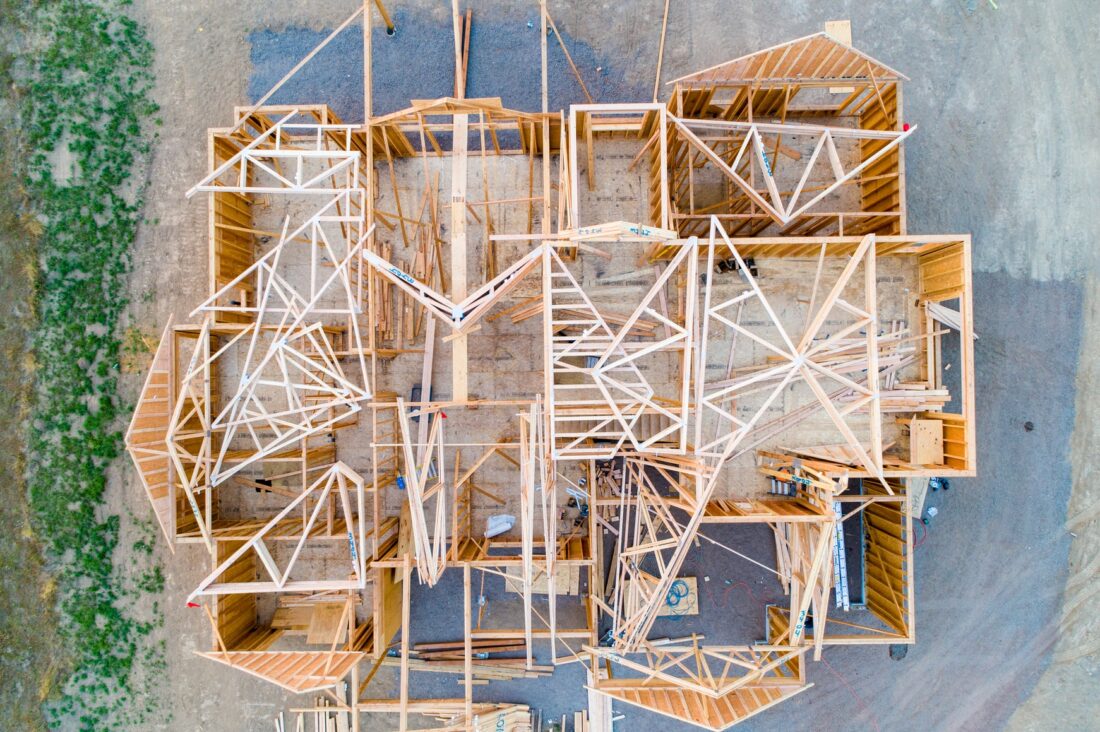

Inventory Shortage

In the last year, there have been significant inventory problems throughout the United States. Shortages for building materials have led to a decrease in new homes being constructed. At the same time, as more and more people have decided to continue working from home, many homeowners are looking to buy houses that better suit their needs.

The increase in demand and decrease in supply has led to serious competition. Buyers are engaging in bidding wars and driving up selling prices because there are so few houses available. The market currently favors sellers, and this trend will likely continue for the next few months.

Low-Interest Rates and Refinancing

The number of new loans may have declined earlier in the year because fewer homes were up for sale, but many homeowners have recently refinanced their mortgages due to the extremely low rates currently available. Interest rates are predicted to stay low for the rest of the year, so you can expect even more homeowners to refinance to take advantage of the circumstances.

Virtual Services

Almost all industries have been incorporating technology into their practices in recent years, but the COVID-19 pandemic caused a sudden and dramatic increase in virtual services in the mortgage industry. Now, buyers can apply and qualify for a mortgage through smartphone apps, and they can even close on their mortgage through a virtual meeting.

The mortgage industry relies heavily on personal relationships, and it can be more difficult to maintain relationships virtually. However, technology opens up so many opportunities for lenders and for buyers, so industry professionals should be prepared to embrace the technological advancements. Staying ahead of the trends will help you thrive in the current market.

Have questions? Speak to an expert for more information.