Small Business Loans For Women

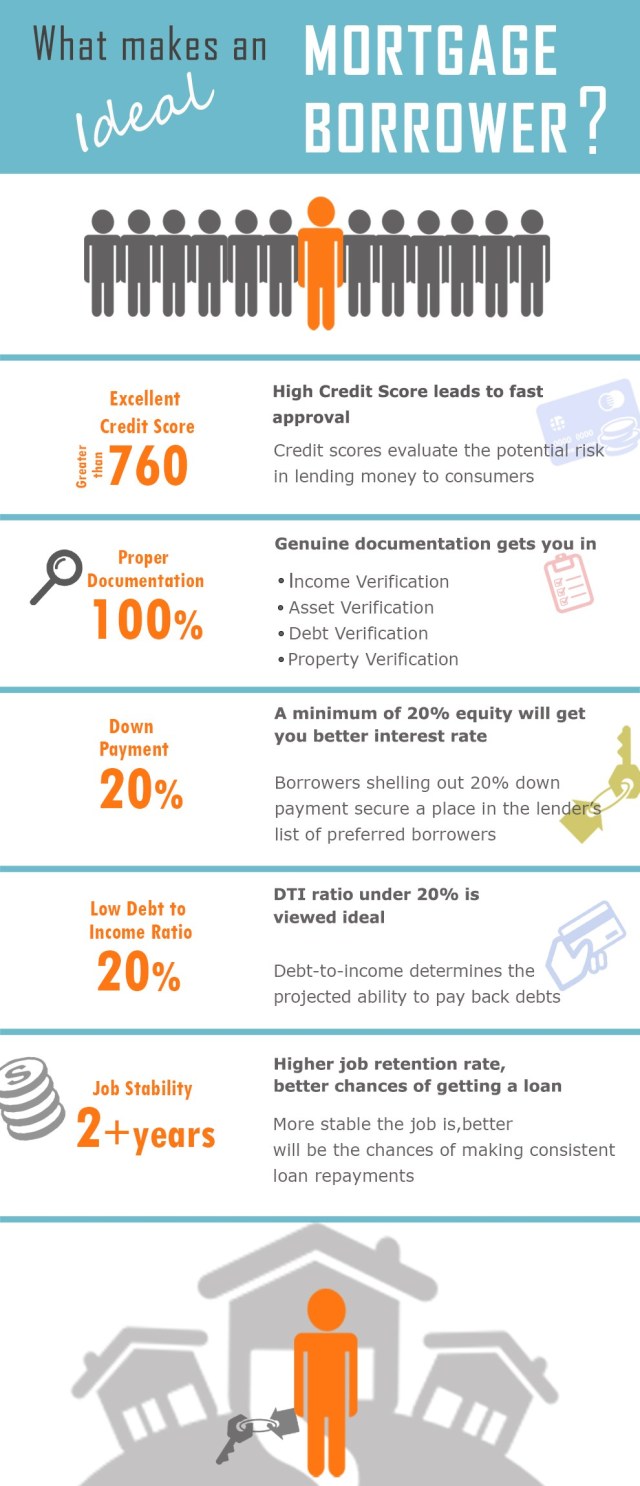

Ready to Start your Small Business? If you’re a woman looking to open her own business, it’s never been easier to become a successful entrepreneur. But to run a successful business, you’ll need more than a great idea and a vacant building–you’ll need enough funding to