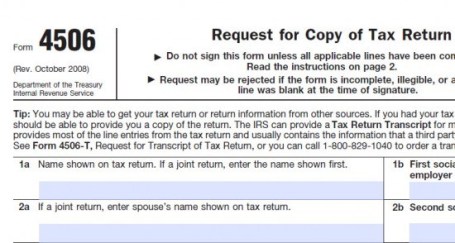

4506-T: Learn More About Us

4506-Transcripts is a leader in the technology and service industry where we specialize in tax verification. We help different organizations to process their 4506-T forms, including legal companies, mortgage bankers and banks. These are Internal Revenue Service documents that allow third parties to retrieve past